Upcoming U.S Non Farm Payrolls NFP 5th April

Upcoming U.S Non Farm Payrolls NFP 5th April. The past non-farm payrolls (NFP) report is a critical economic indicator that provides valuable insights into the health of the labor market in the United States.

Released by the Bureau of Labor Statistics on a monthly basis, this report details the total number of jobs added or lost in non-farm industries, excluding farming and government employment.

Investors, policymakers, economists, and analysts closely monitor this data as it sheds light on trends in job creation, unemployment rates, wages, and overall economic growth.

A higher-than-expected NFP figure typically signals a strong economy and may lead to increased consumer spending and business investments.

On the other hand, a lower-than-expected NFP figure indicates potential weakness in the labor market and could impact financial markets and monetary policy decisions.

Therefore, understanding and interpreting past NFP reports is crucial for making informed decisions in both personal finance and professional settings.

The last Non Farm Payroll trades with us

Before I speak about the non farm payrolls of last months, let me recapitulate on the NFP news released before that. If you have been following me on the website or my youtube channel, you will realise all my predictions for the NFP news have been a success.

We sometimes find challenges when the news comes in competition with other news releases. Besides, I always trust my intuition and find the best trading strategy suited for that challenge.

That’s the case with the past Non Farm Payrolls report. I did put too much attention on the NFP itself and neglected the unemployment rates. The two news mentioned followed by the Hourly Earnings can be a big burden to your trade.

So what happened last time, the direction was very well predicted and and before the news reached its final destination on the chart it reversed very brutally. I’m pretty sure many people have blown their account that day.

Speaking of intuition, I knew something wasn’t right and came up out of the trade very fast before the reversal. I really hope for the upcoming Non Farm Payrolls of the 5th April to trade at full potential.

As a reminder, it’s now been three years since I am on the green trading the NFP news. I really hope what was yesterday will be today and forever. NFP is among the forex news where I really put my energies because it’s worth it.

I always recommend fundamental scalpers, news traders to choose what is important in the forex business as this forex world is just too big. I have also noticed that all the small news that happens during the weeks are really energy drainers.

You can save big money and trade it for big news, don’t be impatient. That will lead you to turn around in a vicious circle with a bonus on headaches and stress. NFP news, CPI news and today’s boring Fed News are really worth trading for a life changing experience.

Forex news prediction calendar on forexnewspredictions.com website

As we speak about small news releases during the week, the website forexnewspredictions.com have created a calendar with news predictions. This is because most of you have demanded more signal services besides what the website had projected for.

Of course since this innovation, the calendar has been helpful for many traders who found interest in it. By checking the predictions history on the calendar, you will notice a lot of wins and few losses.

As you all know, you can’t win it all in this game. But you can if you focus on one, two or three trades only monthly, as I explained above.

My prediction on Upcoming U.S Non Farm Payrolls NFP 5th April

The upcoming non-farm payrolls news scheduled for April 5th, 2024 is anticipated to be a critical event for economists, investors, and policymakers alike.

Non-farm payroll data is a key indicator of the overall health of the U.S. economy, as it provides valuable insights into job creation and employment trends.

Analysts will closely scrutinize the report for any signs of wage growth, labor force participation rates, unemployment levels, and sector-specific performance.

This information is crucial for guiding monetary policy decisions by the Federal Reserve and forecasting market movements. As such, market volatility may increase leading up to and following the release of this highly anticipated economic data.

Traders and investors are advised to stay informed and exercise caution while interpreting and reacting to the implications of this essential report on April 5th, 2024.

At least for now we have an idea of the Unemployment Rates reports to come because of of last prediction. As I said previously we really wish all the news to align in one direction for potential full win.

With the aid of the prediction calendar, we have done a lot to help you win trades and stay profitable. Do me a favour and support my effort by subscribing to receive my accurate prediction on the upcoming Non Farm Payrolls news on the 5th April 2024.

Update Non Farm Payrolls NFP news 5th April 2024

The U.S job market reports and forecasts by economists these days are very messy. You will notice the “actuals” keeps changing upon almost every news release.

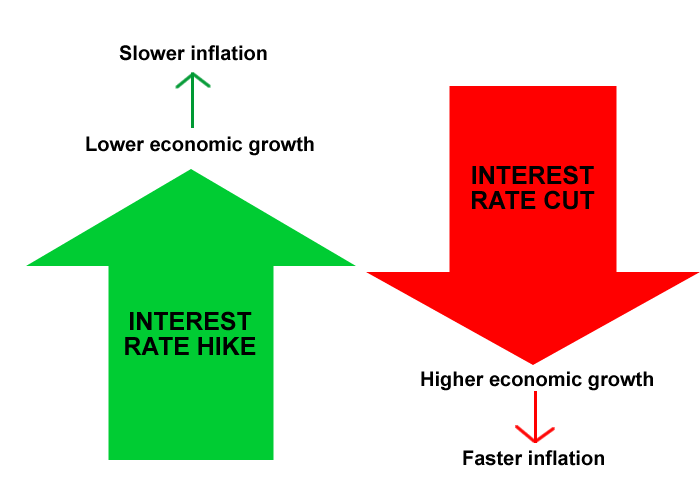

But for us traders, what matters is to beat the forecasts in order to make money. So as per my analyses, it starts to look very true regarding the fed rates cut this year.

Simply because, I have noticed the U.S job market starts cooling. Yes, even the Non Farm Payrolls of 5th April 2024 are going down on the chart.

Given a forecast of 205k by economists on investing.com and 200k on other websites, I strongly believe the result will be above that. So I expect the results to be around 210k-225k for April 5th 2024 NFP news.

In conclusion, I will buy the USD and I am convinced this trade will be at full potential with no ugly surprises. In general, we have a big chance to go bullish with all three news to be released on the same day.

Join me on WhatApp too.