How to Trade Nasdaq: A Guide to Low Spread, High Leverage Brokers

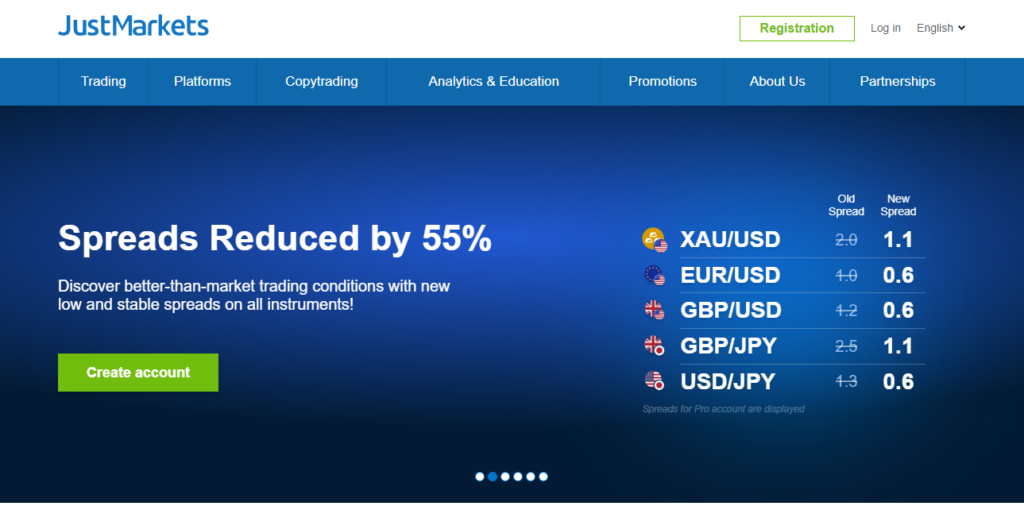

How to Trade Nasdaq: A Guide to Low Spread, High Leverage Brokers. The Nasdaq, short for the National Association of Securities Dealers Automated Quotations, is a stock exchange platform based in the United States. My recommended broker to trade Nasdaq with low spreads

It was founded in 1971 by the National Association of Securities Dealers (NASD) and is known for being one of the first electronic stock exchanges in the world.

The Nasdaq primarily focuses on technology and internet-related companies, but also includes a wide range of other industries such as healthcare, finance, and retail.

It is a popular trading platform for investors looking to buy and sell stocks, as well as other securities like options, bonds, and exchange-traded funds.

One of the key features of the Nasdaq is its electronic trading system, which allows for fast and efficient transactions to take place.

This system is powered by advanced technology and operates 24 hours a day, providing investors with the ability to trade stocks at any time.

Additionally, the Nasdaq is known for its transparency and accessibility, as it offers real-time quotes and market data to help investors make informed decisions.

This level of transparency and information sharing has made the Nasdaq a popular choice for both individual and institutional investors.

In recent years, the Nasdaq has become synonymous with some of the world’s largest and most successful technology companies, such as Apple, Microsoft, and Amazon.

These companies have contributed to the Nasdaq’s reputation as a hub for innovation and growth, attracting investors looking for high-growth opportunities.

Overall, the Nasdaq plays a significant role in the global economy by providing a platform for companies to raise capital and for investors to participate in the ongoing success of these companies.

how to trade Nasdaq with a reputable broker offering low spreads and high leverage for optimal trading conditions.

High spreads brokers vs low spreads brokers

High spreads brokers

High spread brokers refer to financial intermediaries who charge wide bid-ask spreads on the trades they facilitate.

This means that clients end up paying a higher cost to enter and exit positions, reducing their overall profitability.

These brokers often target inexperienced traders who may not fully understand the implications of high spreads on their transactions.

While high spread brokers may offer seemingly attractive leverage and bonuses to entice clients, it is important for traders to carefully consider the long-term implications of trading with such brokers.

One of the key reasons why high spread brokers exist is to generate larger profits for themselves. By widening the spread, they are able to pocket the difference between the bid and ask prices, increasing their revenue.

This can be detrimental to traders, especially those who engage in high frequency trading or rely on tight spreads for their strategy.

High spread brokers may also engage in unethical practices such as price manipulation or slippage, further disadvantaging their clients.

It is crucial for traders to conduct thorough research and due diligence before choosing a broker to ensure that they are not falling into the trap of high spread brokers.

High spread brokers can be a major obstacle to successful trading for individuals seeking to enter the financial markets.

It is essential for traders to be aware of the potential drawbacks of trading with high spread brokers and to carefully evaluate the costs and benefits before making a decision.

By choosing reputable brokers with competitive spreads and transparent pricing models, traders can better position themselves for long-term success in their trading endeavors.

low spreads brokers

Low spread brokers are financial institutions that offer trading services with minimal difference between the buying and selling prices of assets.

These brokers are often favored by traders who engage in high-frequency trading, as lower spreads mean lower costs and higher profits.

By using low spread brokers, investors can benefit from more efficient trading and quicker execution of orders, resulting in improved overall trading performance.

One of the key advantages of using low spread brokers is the potential for cost savings. With lower spreads, traders can enter and exit positions with reduced fees, allowing them to keep more of their profits.

This is especially important for day traders and scalpers who make frequent trades throughout the day and rely on tight spreads to maximize their returns.

Additionally, lower spreads can also lead to more accurate pricing of assets, making it easier for traders to enter and exit positions at favorable prices.

In conclusion, low spread brokers play a crucial role in the financial markets by offering traders competitive pricing and efficient execution of trades.

By choosing a low spread broker, investors can benefit from reduced costs, improved trading performance, and greater opportunities for profit.

As technology continues to advance and competition among brokers increases, the use of low spread brokers is likely to become even more prevalent among traders seeking to optimize their trading strategies and maximize their returns.

High leverage in trading Nasdaq

High leverage in forex refers to the ability to control a large position in the market with a relatively small amount of capital.

This allows traders to amplify their potential profits, as even small market movements can result in significant gains.

However, it also increases the risk of incurring substantial losses, as the same market movements can lead to quick and devastating losses.

Therefore, while high leverage can be a powerful tool for experienced traders seeking to maximize their returns, it can also be a double-edged sword that requires careful risk management.

One of the key advantages of high leverage in forex is the ability to magnify one’s gains by controlling larger positions in the market.

This can lead to substantial profits in a short amount of time, making it an attractive option for traders looking to make quick returns.

Additionally, high leverage allows traders to diversify their portfolio without tying up large amounts of capital, providing more flexibility in their trading strategies.

However, it is important for traders to be aware of the risks associated with high leverage, as even a small adverse market movement can result in significant losses.

In order to effectively utilize high leverage in forex trading, traders must employ strict risk management practices to protect their capital.

This includes setting stop-loss orders to limit potential losses, as well as carefully monitoring market conditions and adjusting positions accordingly.

Additionally, traders should have a solid understanding of market fundamentals and technical analysis to make informed decisions when using high leverage.

By taking a disciplined approach and managing risk effectively, traders can harness the power of high leverage while minimizing the potential for catastrophic losses.

How to Trade Nasdaq: A Guide to Low Spread, High Leverage Brokers

Trading on the Nasdaq can be an exciting endeavor for those looking to capitalize on the fluctuations of some of the largest and most influential companies in the world. How to make $100-$500 everyday trading Nas100

One key aspect to successful trading on the Nasdaq is understanding the importance of low spreads and high leverage.

Low spreads refer to the difference between the buying and selling price of a security, and high leverage allows traders to control a larger position with a smaller amount of capital.

By utilizing these two factors effectively, traders can maximize their potential profits and minimize their risks. When trading on the Nasdaq, it is essential to seek out brokers that offer low spreads on the securities you wish to trade.

A low spread means that you will incur minimal costs when buying and selling securities, allowing you to keep more of your profits.

Additionally, high leverage can amplify your gains by allowing you to control a larger position with a smaller amount of capital.

However, it is crucial to use leverage judiciously, as it can also increase your potential losses. By finding the right balance between low spreads and high leverage, traders can increase their potential for profit while managing their risks effectively.

To successfully trade on the Nasdaq with low spreads and high leverage, traders must also have a solid understanding of market dynamics and technical analysis.

By conducting thorough research and analysis, traders can identify trends and patterns that may inform their trading decisions.

Additionally, staying informed about macroeconomic factors and company-specific news can help traders anticipate market movements and make well-informed trades.

Ultimately, successful trading on the Nasdaq requires a combination of technical skill, market knowledge, and risk management strategies to navigate the volatile and ever-changing world of stock trading.